Now is the time to sign up for an online account at the IRS.GOV website

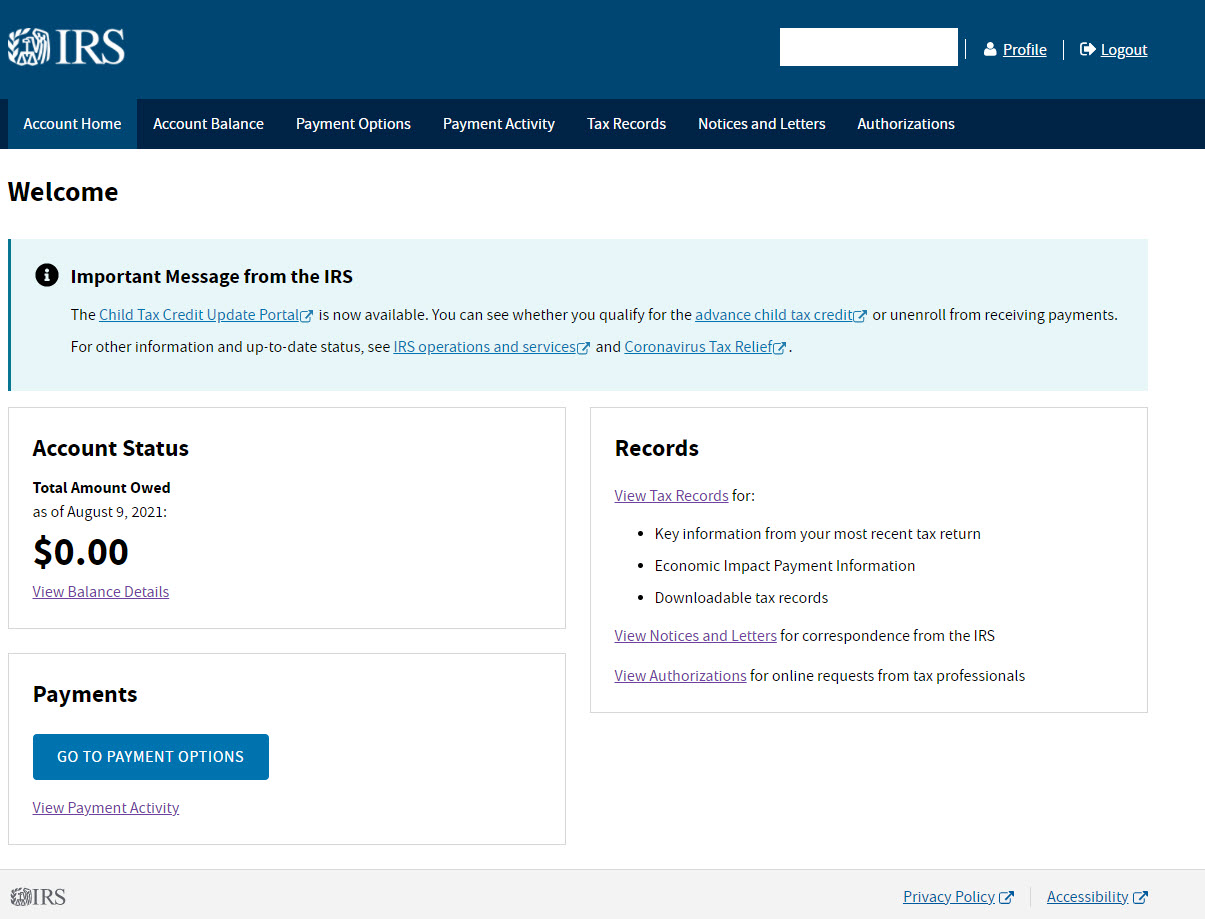

With your online account, you can view:

- The total amount you owe, including balance details by year

- Your payment history and any scheduled or pending payments

- Essential information from your most recent tax return

- Payment plan details, if you have one

- Digital copies of select notices from the IRS

- Your Economic Impact Payments, if any

- Your address on file

- Authorization requests from tax professionals

You can also:

- Make a payment online

- Access the Child Tax Credit Update portal to add or delete dependents or opt-out of advance payments

- See payment plan options and request a plan via Online Payment Agreement

- Access your tax records via the Get Transcript app

- Apply and Receive an Identity Protection PIN (IP PIN) to protect your tax return

- Approve or reject authorization requests from tax professionals

For more information about what is available online, view the IRS Frequently Asked Questions about Online Accounts web page.

Setting Up an IRS Account Requires Patience

The IRS has intentionally created several identity verification steps that may require extra time to obtain your online account. Since it could take up to two weeks for the IRS to authorize your account, you should set up your account before you need it. As we experienced during the COVID Pandemic, reaching the IRS for help via telephone was almost impossible. It is still difficult and time-consuming. The IRS Online Account portal should make obtaining basic tax information easier for taxpayers who have set up a user id and password.

How to Register for an Online Services Account

You will need the following information to register for an IRS ID.Me account:

- Email address

- Social Security Number (SSN) or Individual Tax Identification Number (ITIN)

- Tax filing status and mailing address (You should have your latest tax return open. Use the name, address, and filing status on the tax return.)

- Photo ID (driver's license, passport, passport card, or state ID)

- Mobile phone with a camera, or computer with a webcam.

Review this page on the IRS website to see how the registration process works: How do I verify my identity for the IRS? – ID.me Support

Once you have completed your registration, the IRS system uses two-factor authentication. After entering your user id and password, you will use your mobile phone to receive an SMS text message with a code each time you log on to your IRS account. You can also download the IRS2Go mobile app to generate the security code needed each time you log in to your account. IRS2Go is free and available for Android devices, iPhones, iPads, and Amazon Fire tablets.

What Else Should I Know?

- IRS online accounts are for individuals. A version for businesses is in the works.

- Both you and your spouse should register for accounts. The IRS maintains separate accounts for each spouse, even if you file married filing jointly.

- Currently, you cannot change your address online. Submit Form 8822 by mail when you change addresses.

- You can change your email address and phone number.

- You cannot use the online account portal to make estimated tax payments. You should continue to use the IRS Direct Pay page for estimated tax payments.

- Electronic payments may take five to seven business days to appear on the portal's payment activity screen. Allow three weeks for non-electronic payments to be credited to your account.

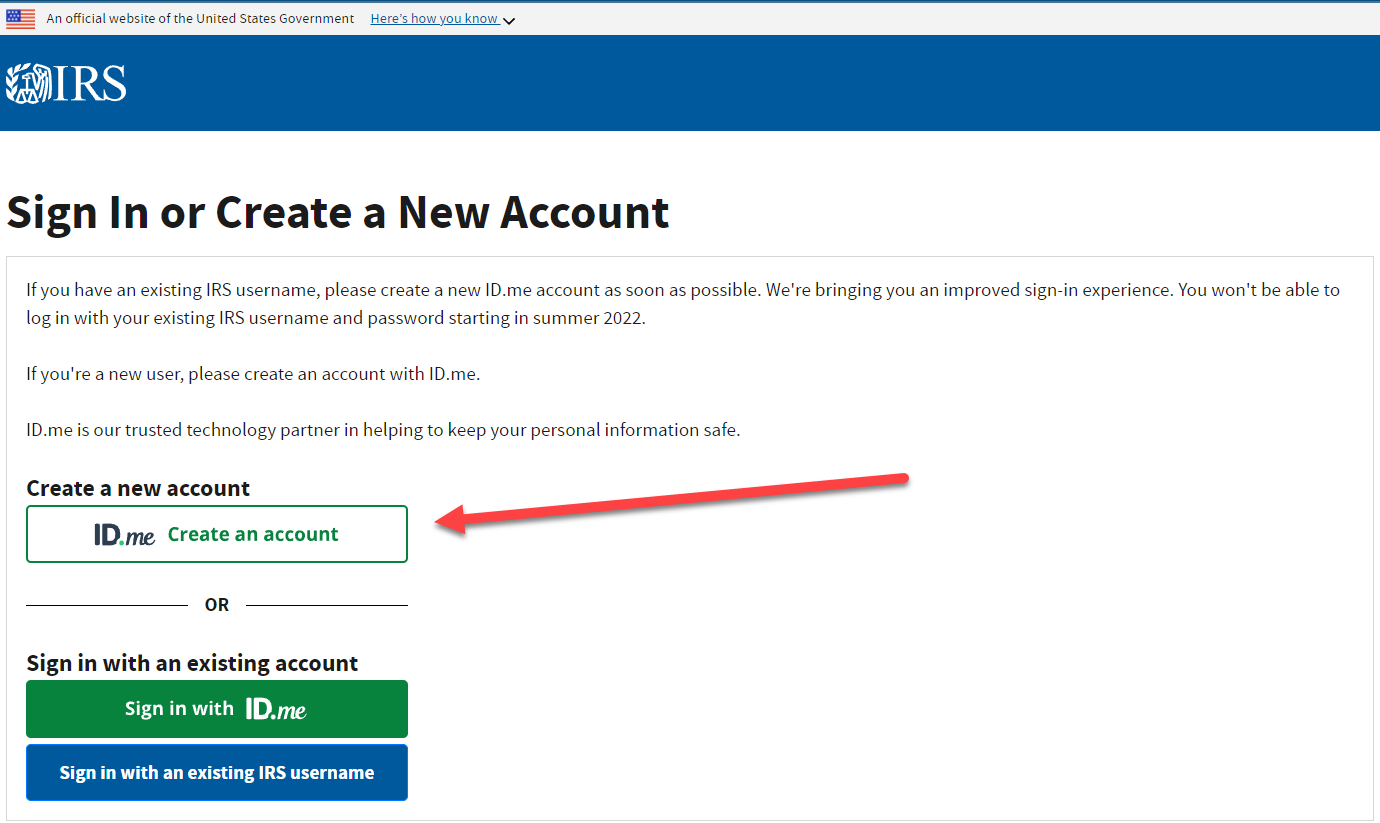

Click on this button to set up your IRS Account:

Bookmark this page since you will use it to access your account in the future. On the IRS page click on this button:

On the next page, click on Create Account. In future sessions, you will use this page to log into your account.

The IRS promises to roll out new features and improvements in the future. This blog post describes features as of November 2021.