An Identity Protection PIN (IP PIN) is a six-digit number that prevents someone else from filing a tax return using your Social Security number. The IP PIN is known only to you and the IRS, and it is used to verify your identity when you file your electronic or paper tax return.

An IP PIN is similar to two-factor authentication procedures that banks and investment companies use to make sure you are the authorized individual who can access an account. In the case of your tax return, it makes sure you are the authorized taxpayer and prevents anyone else from filing a tax return in your name and Social Security number. Why would anyone do that? To create a fraudulent refund and direct it to the criminal’s bank account.

While the IRS has made strides at reducing fraudulent tax returns that illegally obtain refunds, the IP PIN is one way you can assure that you are never a victim of tax fraud. After a fraudulent tax return has been filed under your Social Security number, it is a long and challenging process to prove that you were the victim of tax fraud. With an IP PIN, you can avoid becoming a victim.

How to get an IP PIN

If you are a confirmed victim of identity theft and the IRS resolved your tax account issues, you should receive a CP01A Notice with your IP PIN each year.

Starting in 2021, you may voluntarily opt into the IP PIN program as a proactive way to protect yourself from tax-related identity theft.

There are two steps:

- You must set up an online account with the IRS. Please see this blog post: IRS Improves Online Access To Your Information for instructions on setting up your account.

- Once you have your account, click on this link to the IRS.GOV website: Get An Identity Protection PIN. About halfway down the page, click on the button:

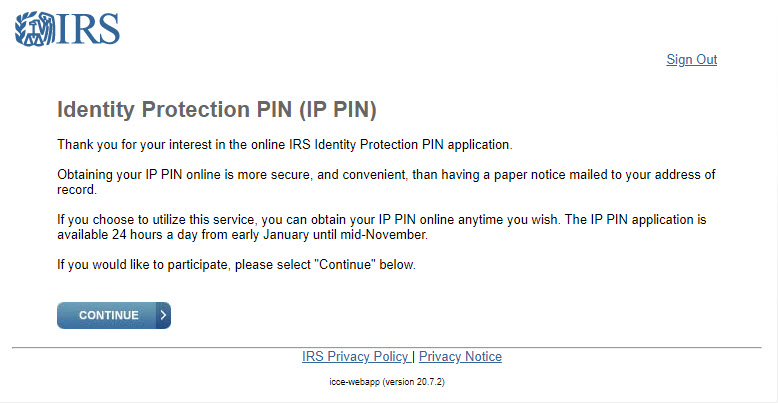

You will log into your IRS account and be taken to a page describing the process and asking you to OPT-IN.

- When you click the Continue button, you will open a page that shows has your IP PIN. You should print this page and keep it with your tax records. You will need to enter this number on your tax return if you self-prepare your tax return or give it to your tax return preparer.

Important Points to Know

- An IP PIN is valid for one calendar year.

- You must obtain a new IP PIN each year.

- The online IP PIN tool is generally unavailable mid-November through mid-January each year.

Lost IP PINs

You may use the Get an IP PIN tool to retrieve your number. Review Retrieve Your IP PIN for details

How to Use Your IP PIN

Enter the six-digit IP PIN when prompted by your tax software product, or provide it to your trusted tax professional preparing your tax return.

Correct IP PINs must be entered on electronic and paper tax returns to avoid rejections and delays. An incorrect or missing IP PIN will result in the rejection of your e-filed return or a delay of your paper return until it can be verified.

Don’t reveal your IP PIN to anyone. It should be known only to your tax professional when you are ready to sign and submit your return. The IRS will never ask for your IP PIN. Phone calls, emails, or texts asking for your IP PIN are scams.

More Information

FAQs about the Identity Protection Personal Identification Number (IP PIN)