Cliick for PDF Version

When I Received a Paycheck I Didn’t Have to Make Estimated Payments, Why Now?

The U.S. tax system is a “pay as you go” system. All your taxes should be paid in the calendar year that you are receiving income and estimated tax payments are required. When you file your taxes in the following year, there should be no taxes due and no refund, if you paid the correct amount. Given the complexities of the tax system, it is almost impossible to pay the exact amount due, so you’ll get a refund or owe more taxes when your returns are prepared.

A company that provides a paycheck is required to withhold income tax, Social Security tax, and Medicare tax from each paycheck to pay these taxes throughout the year. As an employee of the company, you didn’t have to think about paying your taxes because the process was automatic.

Most small business owners don’t receive a paycheck. They are required to make estimated tax payments each quarter to avoid penalties based on the quarter’s income or their expected income for the entire year.

When Do I Make Estimated Payments?

Estimated tax payments must be made at least four times per year, generally by the following dates:

- April 15

- June 15

- September 15

- January 15 of the next year

If the dates above fall on a Saturday or Sunday, the due date could be a day or two later.

How Much Do I Need to Pay?

If the amount of taxes owed when the tax return is filed is “small”, there is no penalty. If the amount owed is “large”, a penalty may be charged by the IRS. The definition of what is a small and large underpayment is determined by the IRS Safe Harbor regulations. When you see the term Safe Harbor it means that if you follow the directions, there will be no legal penalty. If you follow the IRS Safe Harbor rules for paying estimated taxes, the IRS will not charge an underpayment penalty. There are four rules:

- If you didn’t owe any taxes last year, there is no penalty for not making estimated tax payments. You will owe all the taxes on your net profit when the tax return is due, and you will need the funds to pay the bill.

- If you underpaid your estimated taxes by less than $1,000, there will be no penalty.

- If your Adjusted Gross Income (AGI) in the previous tax year was less than $150,000, the IRS will not charge an underpayment penalty if you pay at least

– 90% of the tax you owe for the current year, or

– 100% of the tax you owed for the previous year. - If your AGI exceeded $150,000 in the previous tax year, you must pay at least

– 90% of the tax you owe for the current year, or

– 110% of the tax you owed for the previous year.

The payments to the IRS must be divided up throughout the year on a quarterly basis. If you paid all the owed taxes in one payment on the last day of the year, it is likely the IRS would assess a penalty for not paying throughout the year. The IRS would see the single payment date and calculate the penalty based on the four required payment dates.

If you received an unusually large amount of income in the fourth quarter and made the appropriate estimated tax payment to cover this added income, you can use Form 2210. You’ll avoid the failure to pay estimated taxes penalty by following the steps of this form, as it will show the IRS your income was received in unequal amounts.

How Are Estimated Taxes Calculated?

There are two ways to figure out your estimated tax payments.

Let Software Figure it Out

Most taxpayers learn what their quarterly estimated tax payments are when they receive their finished tax return from their preparer or personal tax software. In both cases, the tax software will generate four vouchers for the estimated payments that are calculated based on the 100% or 110% Safe Harbor rule described earlier. If the voucher amounts are paid on time each quarter, there will be no penalty.

This works well if your income is about the same as the previous year. If your income is much higher in the current year and you make the estimated tax payments based on the previous year’s income, there will not be a penalty. You will owe additional taxes and must make a payment when the tax return is filed. Likewise, if this year’s income is a lot less than last year’s, the payments shown on the vouchers will require you to pay a lot more tax during the year and you will receive a refund when the tax return is filed.

Some taxpayers don’t mind the surprise of owing or getting a refund. Getting a refund is nice but finding that you owe a large amount of additional taxes can be difficult for some when they don’t have the cash readily available to make the tax payment.

Calculate the Estimated Tax Payment Each Quarter

There is a way to avoid paying too little or too much in taxes with your estimates. You can calculate your estimated taxes each quarter based on your net income. The estimated tax calculation is based on the two types of taxes you must pay—Federal Income Taxes and Employment Taxes.

Federal Income Taxes

The federal income tax portion of your estimated payment is based on your average tax rate or marginal tax rate. Your average tax rate is the total amount of tax you paid (line 15 of the Form 1040) divided by your taxable income (line 10 of the Form 1040.)

For example, if your taxable income was $130,000 and the total tax was $21,000, your average tax rate was 16%.

$21,000/$130,000=16%

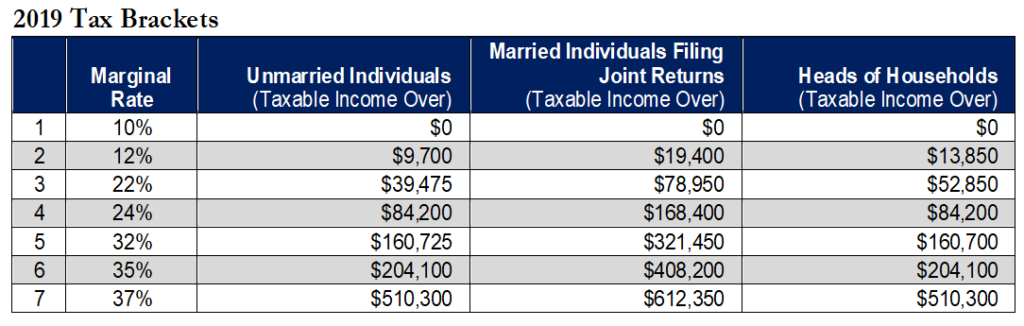

Your marginal tax rate is based on your total taxable income and where it is on the tax brackets table.

In this example, the marginal rate for a married filing joint taxpayer with a $130,000 in taxable income is 24%. $130,000 is greater than $78,950, the maximum income for the 22% bracket (row 3) and it is lower than $168,400 (row 4).

If you are not married, you should probably use your marginal tax rate to calculate your estimated taxes. If you are married,filing jointly, and the majority of the income is earned by the spouse who receives a W-2, then the average tax rate can be used. If the majority of the income is from a small business, then the marginal tax rate should be used.

Employment Taxes

The Self-Employment Tax is based on the amount of Social Security tax and Medicare tax every U.S. worker must pay. The tax rate in 2019 is 15.3% on the first $132,900 of net income, plus 2.9% on the net income in excess of $132,900. This is the same amount that is collected for each employee paid with W-2 wages. The difference is that for employees receiving a paycheck, the company pays half employment taxes and the employee pays half each payday. As a small business, you are required to pay the company and the employee portions. However, like all companies, half of the tax you pay—the company portion—will be subtracted from your income as a deduction. In other words, you get the same tax deduction that larger companies receive.

How to Calculate the Federal Estimated Taxes

To calculate the quarterly estimated tax payment, you combine the income tax rate (marginal or average) with the self-employment tax rate (15.3%–rounded to 15%). For the taxpayer described in our example (using the average tax rate):

16%+15%=31%

Each quarter, the taxpayer would create a profit and loss statement from the business’ accounting software using the same criteria as the Form 1040 Schedule C. The taxable net profit would be multiplied by 31% to calculate the required estimated tax payment. If the net profit in the quarter was $10,000, multiplied by 31%, the estimated tax payment would be $3,100.

Don’t Forget Your State Estimated Payments

In states that collect income tax, you will need to use the vouchers received with your tax return, or calculate the estimated taxes each quarter based on the income tax rates published for the state. Many tax returns will show your average state income tax rate in a summary table in your tax return package. If you are making the estimated state tax each quarter, multiply your state rate times your net profit to calculate the amount of your estimated payment.

How Do You Pay the Estimated Payment?

If you are paying with vouchers that came with your tax return, you can write a check and mail it with the voucher to the mailing address shown on the voucher.

Federal Electronic Payments

For the Federal estimated tax payment, you can make your payments at the IRS Direct Pay with Bank Account web page: https://www.irs.gov/payments/direct-pay. The first time you use this system, you will create an account. You will be asked to verify your identity by entering information from a previous year’s tax return. After the account is created, follow the steps shown on the website to make your payments each quarter.

If your small business is using payroll software, you are already required to make withholding and employment tax payments using the U.S. Treasury’s Electronic Federal Tax Payment System (EFTPS). You can also make your estimated payments on this system. It is a little more work to enroll, but the system will allow you to make a current payment and schedule future payments. The EFTPS web page address is https://www.eftps.gov/eftps/.

Both federal systems will allow you to log in and see the payments you previously made or when a future payment has been scheduled.

State Electronic Payments

Most states also have websites for electronic payments. In your web browser search for your state’s tax web page and follow the instructions for setting up an online account to make payments.