The IRS says that there are four ways to let them know when you move and have a new address.

- Do Nothing — When you file your next tax return, enter the correct address. The IRS will update your address to the one shown on your tax return. The trouble with this method is that if the IRS sends you correspondence about a previously filed return it may go missing in the mails if the U.S. Postal Services fails to forward the letter. Blaming the Post Office for not responding to an IRS letter is not a good excuse.

- Call the IRS — You can look up the number of your local IRS office and call them. Be prepared to provide information to prove your identity. Given the lack of funding for customer service at the IRS, you might be on hold for a long time waiting to provide the information necessary.

- Write a Letter — The IRS will accept your change of address with a letter. The letter must include your full name, the old address, the new address, and your Social Security Number, ITIN, or EIN. The trick here is that you need to send the letter to the address where your last tax return was filed. Since most taxpayers e-file their returns, it is not obvious what address you should use. You can find the address below.

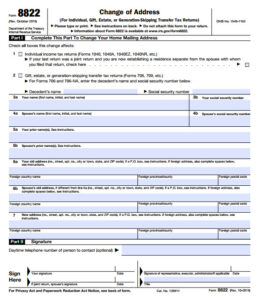

- Use IRS Form 8822 — As with most IRS procedures, there is a form. In this case, it is Form 8822, Change of Address. You should download the form and fill out and sign the first page.

The second page of the form has a table that shows the IRS mailing address based on the state where you live. If you want to write a letter, you can download the PDF document and look on the second page for the correct mailing address. I think filling out the form is easier.

Once the IRS receives the form, it will take up to 6 weeks to process it.